Wealthy Canadian businessman Edward Gong has agreed to pay millions of dollars to the New Zealand government in the largest ever settlement made under the Criminal Proceeds (Recovery) Act since the law came into effect in 2009.

A wealthy Chinese-Canadian businessman has agreed to forfeit more than $70 million by cutting a record-breaking deal with the New Zealand police.

Three years ago, the bank accounts of Xiao Hua Gong in New Zealand were frozen as part of a global investigation into his finances.

The businessman had built a business empire in Toronto including a hotel chain and television channels, as well as attending fundraisers for Canada’s Prime Minister Justin Trudeau and donating to the governing Liberal Party.

But the entrepreneur, better known as Edward Gong, was then forced to deny his success and influence was gained from an alleged $202 million pyramid scheme selling medicines in China.

He was arrested in Canada and charged with fraud and money laundering in December 2017 in connection to the alleged pyramid scheme involving the “fraudulent sale of hundreds of millions of dollars” in shares in China.

The Asset Recovery Unit of the New Zealand Police were also involved in investigating $77m – alleged profits from the pyramid scheme – deposited into Gong’s New Zealand bank accounts over seven years.

Nine months before Gong’s arrest in Canada, a High Court judge granted freezing orders over Gong’s assets in New Zealand which include $69.5m held in bank accounts and an Auckland home worth $2m.

Those assets were restrained under the Criminal Proceeds Recovery Act, which essentially forces someone to prove how an asset was paid for.

For the asset to be forfeited, the police still have to prove criminal offending took place but only on the “balance of probabilities”, the level of proof necessary in civil cases, not the much higher criminal threshold of “beyond reasonable doubt”.

.

.

Gong has previously said the evidence used against him in China was gathered by coercion.

Despite this, Gong has cut a deal with the New Zealand Police, where he has agreed to forfeit more than $70m instead of fighting the case in the High Court.

In a statement released by Police National Headquarters today, Detective Inspector Craig Hamilton said the forfeiture was the largest ever under the criminal proceeds law.

He thanked Chinese and Canadian authorities, and said the case showed New Zealand was capable of investigating complex alleged money laundering cases involving multiple jurisdictions.

“We are committed to making our country the hardest place for criminals to do business, and we will not tolerate those who operate in other parts of the world hiding their illicit proceeds here,” said Hamilton, the national supervisor for the police asset recovery units.

“This outcome sends a simple message to criminals around the world — send your dirty money to New Zealand and you will lose it.”

The announcement comes shortly after an international report on money laundering rated the New Zealand police as among the best in the world at seizing criminal profits.

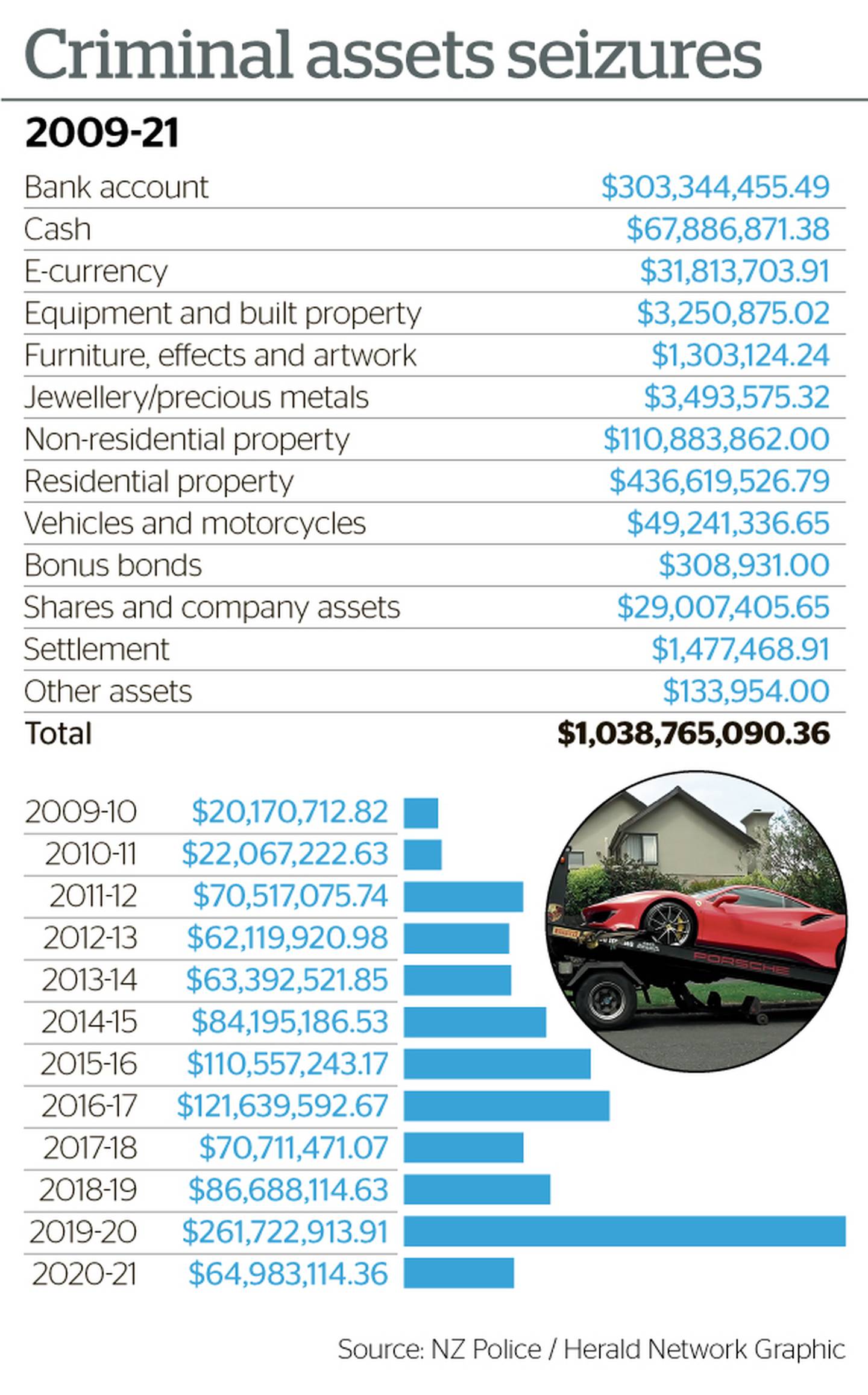

The success of the police in enforcing the Criminal Proceeds Recovery Act was “impressive”, according to the Financial Action Task Force (FATF) based in Paris, as more than $1 billion in alleged criminal wealth has been frozen since the powerful law came into effect just over a decade ago.

The police investigation into Gong also uncovered how the mother-and-son duo running an Auckland finance firm failed to report $53.4m of suspicious transactions instigated by Gong

Fuqin Che and her son Michael Fu were in charge of Jiaxin Finance Limited, a money remitting service, were found guilty of four charges laid under the Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT).

The Asset Recovery Unit also discovered that Gong’s brother Yu Ping Gong, a plumber in Auckland, declared less than $1000 in income over five years – despite earning more than $2m in that time.

As a result, Yu Ping Gong lost nearly $5m worth of property as part of the settlement with police, as well as paying an outstanding tax bill of $1.2m.

The separate settlement reached with Edward Gong announced today brings to an end nearly three years of legal wrangling.

The $70m forfeiture easily dwarfs the previous largest forfeiture under the Criminal Proceeds Recovery Act, which was the $42.5m paid in 2016 by one of New Zealand’s most controversial citizens.

William Yan, better known as Bill Liu, also agreed to a settlement without any “admission of criminal or civil liability” after his New Zealand assets were frozen in 2014 following allegations of fraud in China.

As part of the unusual civil deal, and despite his ongoing protest of innocence, Yan also agreed to return to China to stand trial on fraud charges on which he was convicted.

He then returned to New Zealand to plead guilty to a single money laundering charge – which was also part of the settlement – and served five months’ home detention in his Metropolis penthouse apartment.

He now lives in Hong Kong.

The Gong and Yan settlements are easily the two largest successful forfeitures under the asset seizure law so far.

Another case, also involving New Zealand police helping overseas law enforcement, involves the restraint of $140m in a bank account of a New Zealand company linked to a Russian “computer genius”.

Alexander Vinnik was arrested while on holiday in Greece in 2017 and extradited to France last year, where he was convicted of laundering millions of Euros for cyber criminals.

He was sentenced to five years in prison in France, and now faces the possibility of being extradited to the United States on further charges connected to BTC-e, where at least $4 billion worth of bitcoin was traded with “high levels of anonymity”.

While the exchange of bitcoin is entirely legitimate, prosecutors from the US Department of Justice allege Vinnik created a customer base for BTC-e that was “heavily reliant on criminals” by not requiring users to validate their identity, obscure and anonymise transactions and the source of funds, and lacked any anti-money-laundering processes.

If the forfeiture action taken against Vinnik in New Zealand is successful, it means the three biggest cases – $250m combined – under the Criminal Proceeds (Recovery) Act 2009 involve the wealth of alleged criminals overseas being moved to New Zealand.

In the past, the law has most often been used to seize wealth accumulated by gangs and drug dealers but has pushed into new territory in recent years.

There have been a number of cases involving fraud or alleged tax evasion, alleged movie piracy and cryptocurrency, foreign corruption, and even a workplace fatality.

.

.

By Jared Savage, June 16, 2021, published on NZ Herald