Contrary to the widely-held belief that the cryptoasset industry is unregulated, US regulators are increasingly imposing significant financial penalties on crypto businesses – for fraud, breaches of AML regulations, offering unregistered securities and sanctions violations.

Cryptoasset businesses are subject to many of the same laws and regulations as any financial services business that is based in the US, or serves US citizens. These are some of the most stringent rules governing the provision of financial services in the world, and crypto businesses invest huge resources in complying with the likes of anti-money laundering and sanctions obligations.

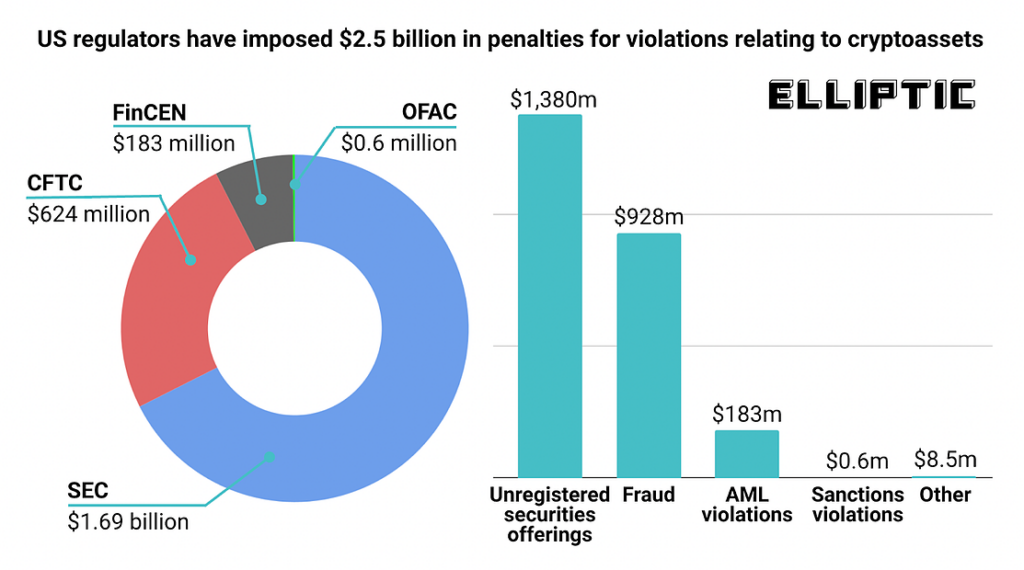

Just as traditional businesses and financial institutions are penalised by regulators for violations of these rules, so too are crypto businesses. Elliptic’s analysis of US regulatory enforcement actions since the birth of Bitcoin in 2009 shows that $2.5 billion in penalties have been imposed against firms and individuals dealing in crypto.

This includes penalties imposed by the SEC ($1.69 billion), CFTC ($624 million), FinCEN ($183 million) and OFAC ($606k).The majority of these penalties relate to unregistered securities offerings ($1.38 billion), fraud ($928 million) and AML violations ($183 million). The penalties can be categorised as civil penalties ($722 million), disgorgements ($1.62 billion) and restitutions ($161 million).

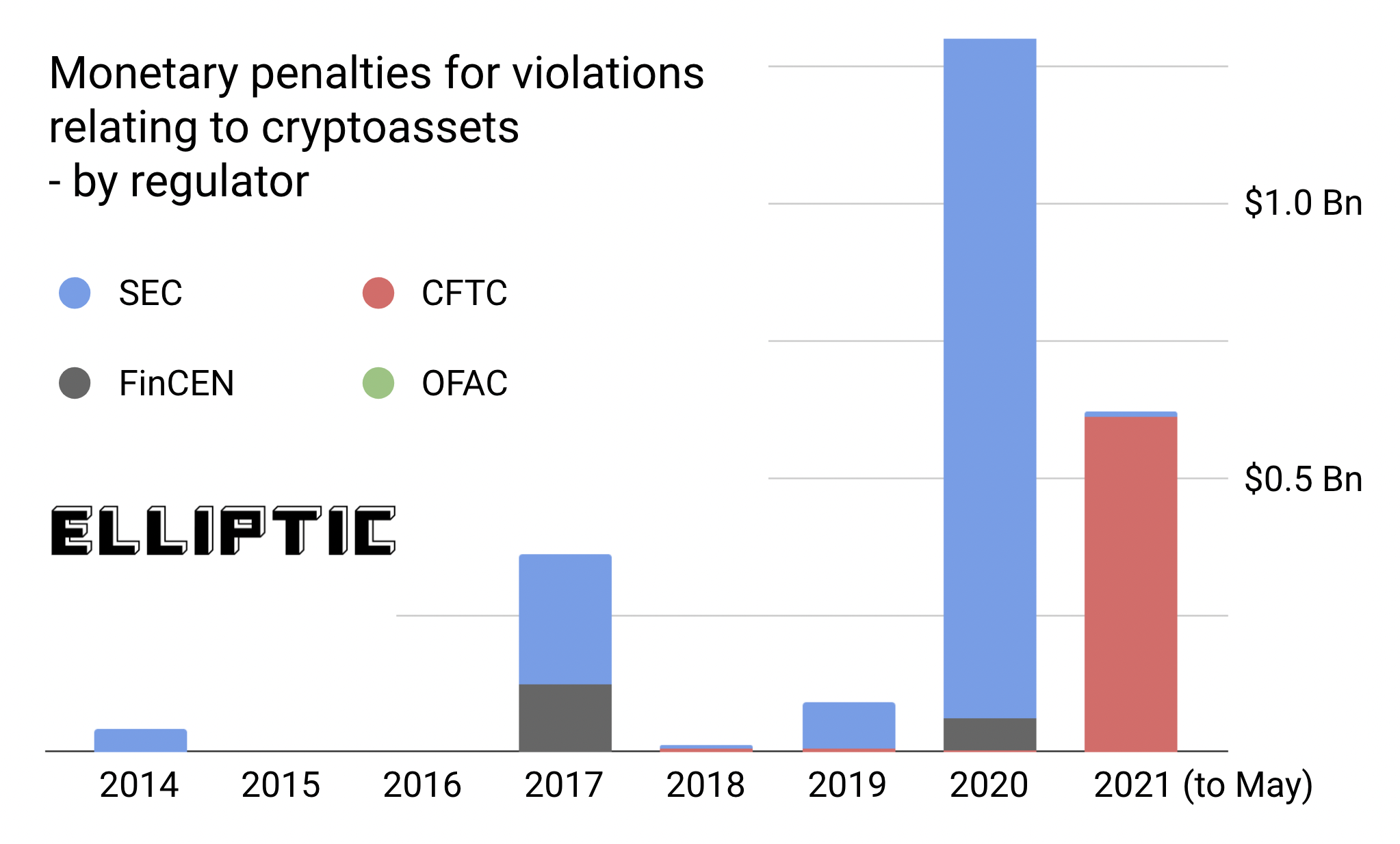

The first major action came in 2014, with the Securities and Exchange Commission (SEC) ordering Trendon T. Shavers and Bitcoin Savings and Trust to pay just over $40 million in penalties for operating a ponzi scheme that defrauded investors out of more than 700,000 bitcoins. Whether it’s US dollars, bitcoins, or magic beans, the SEC demonstrated that whatever the assets or technologies being used, ponzi schemes are a form of fraud that can be pursued using the same old laws.

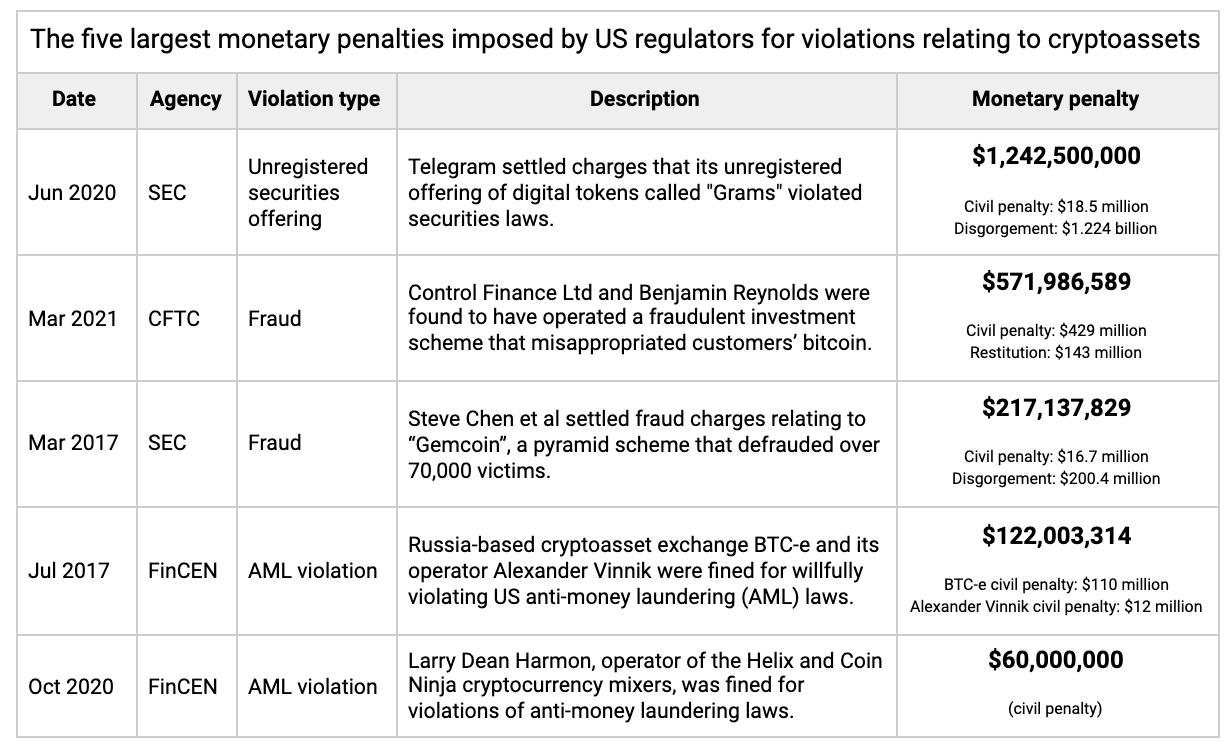

In 2013 the Financial Crime Enforcement Network made clear that exchangers of “virtual currencies” are subject to the Bank Secrecy Act, just like any other money services business. This requires them to detect and prevent money laundering through recordkeeping, customer identification and other measures. One business that failed to do this was BTC-e, a Russia-based cryptoasset exchange that was heavily-used by criminals to launder proceeds of crime in cryptocurrency. Despite not being based in the US, BTC-e did serve US-based customers, allowing FinCEN to impose a penalty of $122 million on the business and its operator Alexander Vinnik in 2017.

2017 also saw the rise of the “initial coin offering” (ICO), where startup businesses and projects raised billions of dollars in capital, in the form of cryptocurrencies such as Bitcoin or Ether, through crowdfunding. In return, the “investors” received blockchain-based tokens that were meant to represent some kind of interest in the project or business. Unfortunately many of these ICOs violated securities laws and/or were outright fraudulent, and the SEC has been pursuing those that administered and promoted these ICOs ever since.

The largest such action so far came in 2020 when Telegram Group Inc. and its wholly owned subsidiary TON Issuer Inc. settled SEC charges that Telegram’s unregistered offering of digital tokens called “Grams” violated federal securities laws. The defendants agreed to return more than $1.2 billion to investors and to pay an $18.5 million civil penalty.

More recently, the Commodity Futures Trading Commission (CFTC) has emerged as a major source of enforcement actions against crypto businesses, for violations relating to fraud, reporting failures and wash trading. In March 2021, UK national Benjamin Reynolds was ordered to pay nearly $143 million in restitution to defrauded customers and a civil monetary penalty of $429 million. This followed CFTC charges of fraud and misappropriation against Reynolds and Control-Finance, a purported crypto investment scheme.

The latest agency to engage in enforcement actions against crypto businesses is the US Treasury’s Office of Foreign Assets Control (OFAC). OFAC administers and enforces economic and trade sanctions against foreign states, organizations and individuals deemed to be a threat to US national security. Such sanctions apply equally in cryptocurrencies as in any other asset, and OFAC has over the past year imposed monetary penalties on two cryptoasset businesses, for sanctions violations.

Our analysis of cryptoasset-related enforcement actions in the US, demonstrates that crypto is far from being the “wild west” of finance. Regulators have successfully used existing laws to halt and penalise illicit activity that has exploited cryptoassets – from ponzi schemes to money laundering operations – and to hold businesses accountable for compliance failures.

Regulatory enforcement ensures that bad actors cannot thrive, and brings clarity on how regulations written decades ago are to be applied to new technologies. In this way it is helping cryptoassets to gain greater acceptance and legitimacy.

.

By Dr. Tom Robinson, 21 June, 2021, published on Elliptic