FX Trading Scams

The role of social media in furthering financial crime is not slowing down. Following on from our previous blog series “How Social Media is used to Further Financial Crime – Part 1 and 2” which focussed on money mules, FINTRAIL has taken a deeper look into the world of FX or forex trading on social media platforms. FX trading scams are schemes used to defraud traders by convincing them that they can expect to gain a high profit by trading in the foreign exchange market.

.

Research and methodology

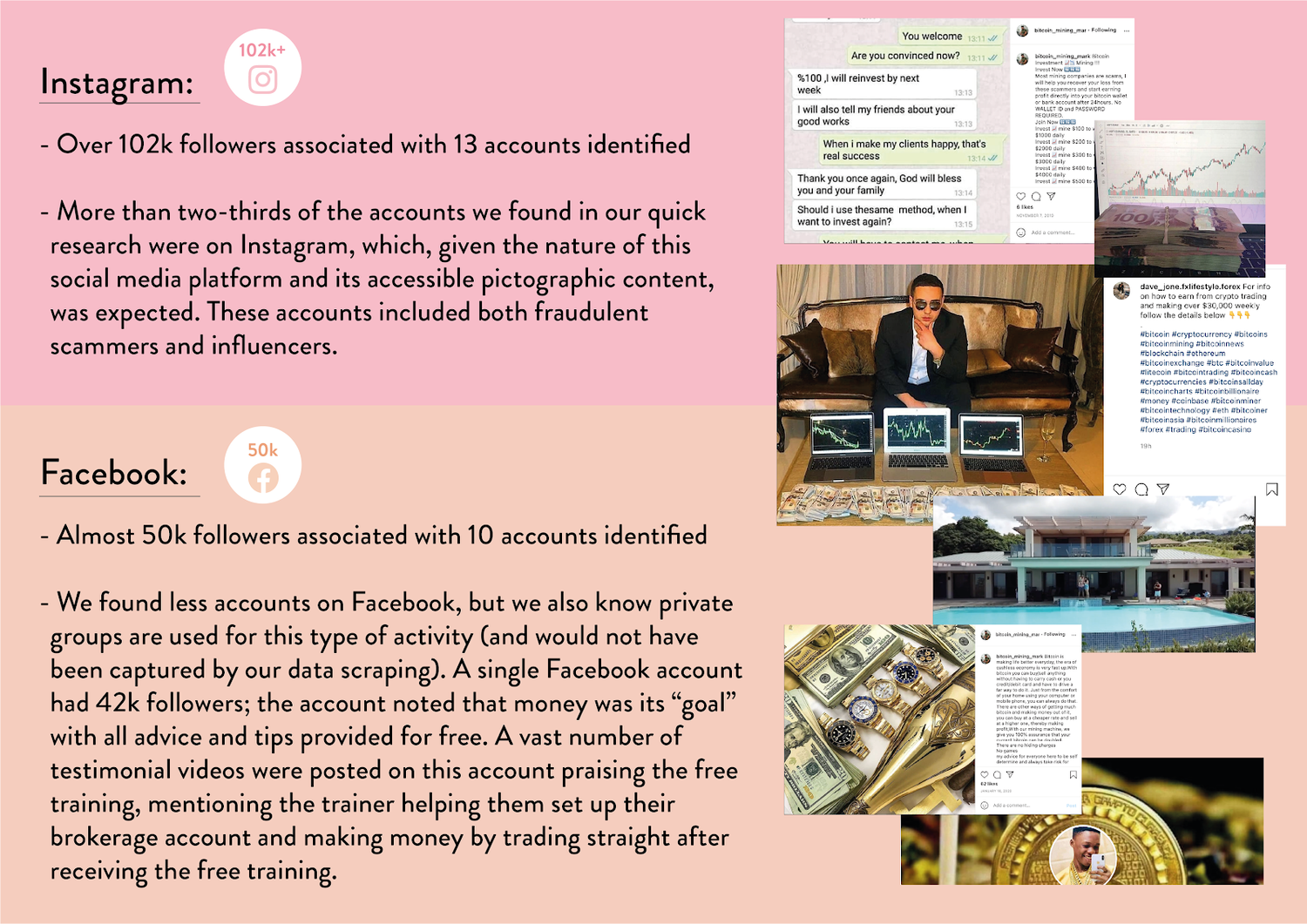

We decided to dig around to see just how widespread these forex scams are. FINTRAIL conducted research through inert observation without any direct contact, and using just four basic FX trading associated terms. We investigated accounts on two social media platforms: Instagram and Facebook. Once accounts were identified, these were manually reviewed to assess the activity.¹ What we found is detailed below.

.

Findings

.

Visual – A culmination of images are displayed on the profiles of these FX Scam pages. Key features include cash, cars, watches, designer clothes, stock market graphs and “evidence” that people have received large amounts of money directly into their bank accounts.

.

Language – The language used on the profiles followed a pattern: first, how much money you could make in a specified time period, then that investment was key and then finally a “DM” or WhatApp request for further details. One other key feature that popped up on some profiles was the phrase “I don’t like scammers”, which is ironic!

.

What is FX trading?

Foreign exchange trading, also known as FX trading or forex trading, is the exchange of different currencies on a decentralised global market. It provides the opportunity to speculate on price fluctuations within the FX market. The goal of FX trading is to forecast if one currency’s value will strengthen or weaken relative to another currency.

.

FX scams

Due to the high gains that can be made from FX trading, we have seen multiple scams exploit victims who are looking to make a profit, fast. These scams are not new, but scammers have easier means of obtaining their victims thanks to social media. Instagram, Facebook and LinkedIn are swarming with accounts claiming to have the secrets to FX trading success—a quick “DM” or WhatsApp to the account’s owner will make you rich!

There have been many variations of forex scams over the years with three types currently being the most prominent:

- Robot scams – A Forex robot is a trading program that uses algorithms, or lines of computer code, as technical signals to open and close trades. Not all Forex robots are scams. However scammers tout their system’s ability to generate automatic trades that, even while you sleep, earn vast wealth.

- Signal sellers scams – Forex signal sellers are individuals who send out trade ideas which usually include a currency pair, direction, entry price, stop loss and target levels. Many of signal-seller scammers simply collect money from a certain number of traders and disappear. Some will recommend a good trade now and then, to allow the signal money to perpetuate. Although there are signal sellers who are honest and perform trade functions as intended, it pays to be skeptical.

- Trading investment scams – There are many adverts nowadays promoting phony forex trading investment scams and fake forex investment funds. At the heart of it FX trading investment scams strong arm you into a multi-level marketing scam aka a pyramid scheme. So rather than focusing on trading (which was the reason you initially joined) you focus on recruiting new members to the platform/company because you earn commission for every new joinee.

.

The influencer effect

Most influencers are working for themselves, but there can also be a deeper motive with links to large organised crime groups or even sanction-related players. We have seen this in the recent case of “Hushpuppi” (Ramon Olorunwa Abbas), a Nigerian influencer with over 2.5 million followers on Instagram.² He has now been detained by the US and not only alleged to have helped launder the proceeds of social engineering fraud and computer hacks, but also helped North Korean hackers launder more than $1.3 billion from a Maltese bank.³

Forex influencers often suggest their wealth has been made through trades, but this is highly unlikely. They generally earn a fee by selling daily “signals” and/or “mentoring” or gaining commission from each signup/trade placed, without warning their followers of the associated risks of losing money (which they’re legally obliged to do). Online influencers rarely ever see the multitude of consequences and repercussions that plague the lives of people they offer their unregulated advice to. And it’s not clear if these influencers are subject to any content moderation by the platforms they use. Some online companies restrict the rates of return that can be advertised and ban the use of terms that are associated with unrealistic claims⁴, but—especially given our findings above—this hasn’t been enough.

The FCA does provide a warning list which catalogues firms offering these “signals” and “mentoring advice”. Some internet firms also have made changes to their policies to restrict the rates of return a firm can advertise and ban the use of terms that make unrealistic claims⁵. Considering the amount of money being lost by victims these changes may appear to be too little, too late.

.

Being practical

To avoid being a victim, keep any eye out for the following:

- Lack of regulation – check whether an FX trading scheme is on the Financial Conduct Authority (FCA) register or warning list. If they are not on the FCA register, your investment will not be protected by the Financial Services Compensation Scheme and you could lose money if there was malpractice.

- No live track record – if the FX trader has a live record, they’ll often send you a link to a tracking website such as “myfxbook.com”. Conversely, they’ll only show you stats from demo accounts—this only proves their ability to make/lose virtual money.

- Pressure to deposit money – an FX trader would want you to be comfortable when investing with them and would never pressure you to deposit funds or try to incentivise you to act quickly. And advice to not withdraw your money at any time should also be met with caution.

.

March 16, 2021, published on FINTRAIL